Our Practice Areas

Tran & Tran Law Firm

Driven by a relentless commitment to client success, Tran & Tran Law Firm provides more than legal counsel—we offer a strategic partnership grounded in precision, insight, and dedication. We work closely with our clients from the earliest stages of their business through to a successful exit, guiding them through the challenges of growth, real estate complexities, and the pursuit of long-term goals. Every step of the way, we tailor solutions to protect their vision and accelerate progress. At Tran & Tran Law Firm, we believe that in business, as in law, results aren’t just the goal—they’re the standard. Results Matter.

Experience

Blog

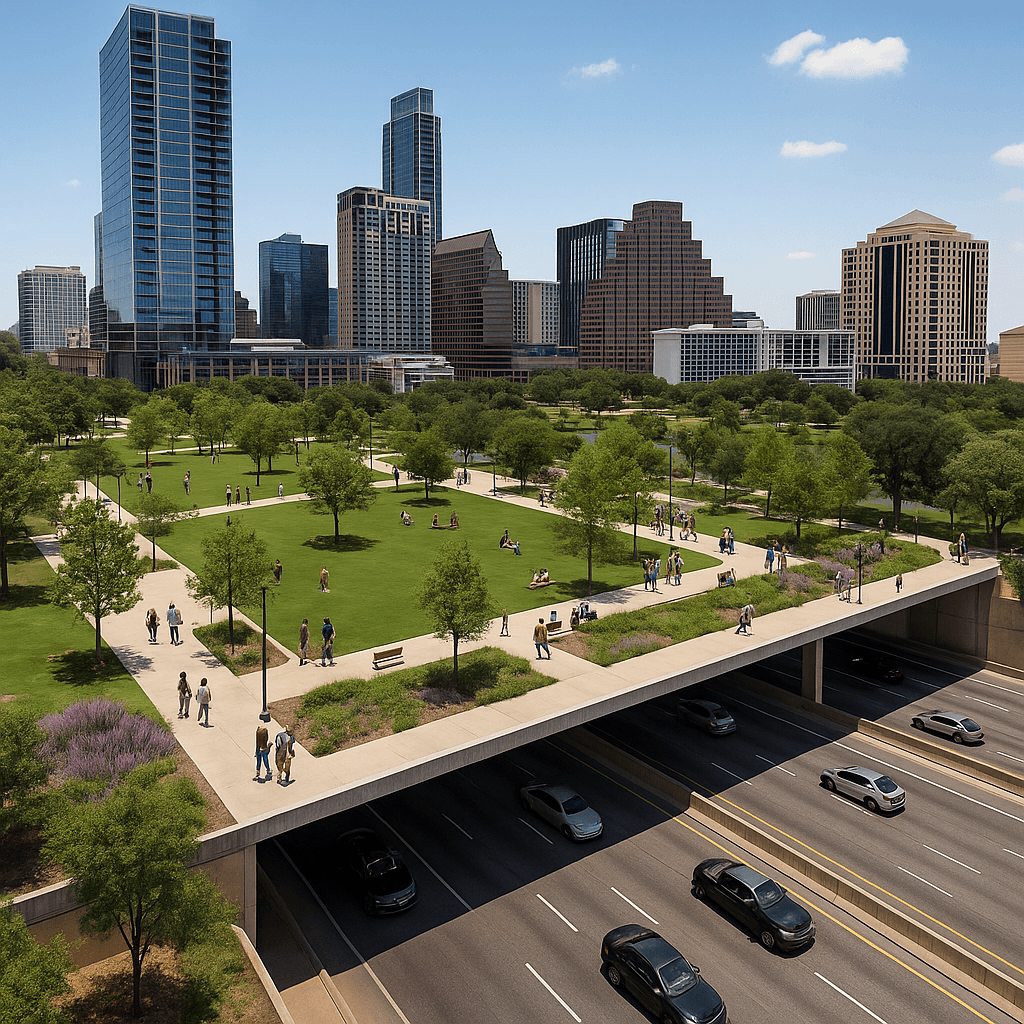

What the Final I-35 Cap and Stitch Plan Means for Downtown and East Austin

Well, I think its finally over. We have a plan for what is going to happen with the new I-35. There has been a debate

Starbase and the Return of the Company Town

If you are a long-term read reader of this blog – first, I’m sorry – but second then you’ll know I’ve written previously about the

Austin Embraces Single-Stair Apartments to Tackle Housing Crisis

I talk a lot about housing in this blog. I try to focus all across Texas – but I live in Austin so that is